New China boxboard market advisory study 2022-2026 (2022 edition): The nation's new phase sees food grades leading the growth, while both supply consolidation and expansions are changing the imports and exports outlook.

Hong Kong, China, May 2022 (Press Release) – NPC Partners, a premier, innovative consultancy committed to assist the pulp & paper industry in developing new solutions, have announced the release of 2022 edition China Boxboard Industry Advisory Report: Strategy & Market Analysis (2022-26).

China is the largest boxboard market in the world, with imports and exports recording nearly 0.75 million tonnes and 1.6 million tonnes in 2021. In terms of annual volume, total demand for boxboard in China grew from nearly 11.7 million tons in 2011 to about 17.3 million tons in 2021, and in terms of total sales, the boxboard market grew to US$14.3 billion in 2021.

In 2020, the overall boxboard demand rebounded by 1.8%, despite the disruptions of the COVID-19 pandemic. In 2021, total boxboard growth was estimated to further move up to 2.6%. Virgin fiber-based boxboard led the growth, while the recycled grades market is undergoing continuing restructuring. The fast economic recovery, strong demand in health protection goods and home related products, changing consumer perception and government push for sustainable packaging all contributed to this turning trend.

NPC Partners also found that in recent years demand-and-supply balance have been improving for boxboard grades, which provide more solid supports to a possible price rise in both coated duplex and FBB grades.

Considering the emergence of the “new normal” economy in China's paper industry, restructuring activities in the boxboard sector, improved market balance (2020–2021), and NPC Partners’ forecasts on the demand, supply, and trade fronts, it could be foreseen that some existing boxboard producers will find themselves in a more advantageous position, and opportunities for expanded import volumes could become available.

Companies relevant to China and the global boxboard sector will need to review China's role in their existing business strategy and assess their potential opportunities and risks. NPC Partners’ 2022 study reveals new growth opportunities and exclusive insights in the boxboard market, both inside and outside China:

1. Food-related demand (including liquid packaging board and cupstock grades), supported by both consumer and policy factors, will be the primary driving force for boxboard, and its growth in future years may outpace supply.

2. Virgin grades can expect a new wave of supply expansion, outpacing the demand, while recycled grades continue further rebalancing. Therefore, export of virgin grades and import of recycled grades will likely see some growth.

3. New pricing patterns are being formed as new capacity and M&A-led consolidations, economic recovery, and policy factors kick into a demand-and-supply balancing act. Examples are Asia Pulp and Paper’s (APP’s) takeover of Bohui Paper, and government-led mill closures in Fuyang.

4. A comprehensive and exclusive analysis of new drivers in China’s paper industry and the impact of new policies reveals a number of findings; for instance, new plastics-limit initiatives and an imported wastepaper ban are among the new key factors the boxboard industry faces.

5. Exclusive analysis of new market changes in 2020–2021, including the impact of the COVID-19 outbreak, combined with the strategic perspective to points 1–4 above.

The latest assessment of COVID-19’s impact on China’s economy and boxboard demand, plus the new guidelines from China’s 14th five-year plan on the paper industry, have also been integrated into the 2022 edition of the report.

Subscribing to this new report could help companies form a comprehensive understanding of the new market dynamics and use new tools to analyze demand (by sub-grades and by end uses), cost, and market structure so as to conceive better business planning and capture growth.

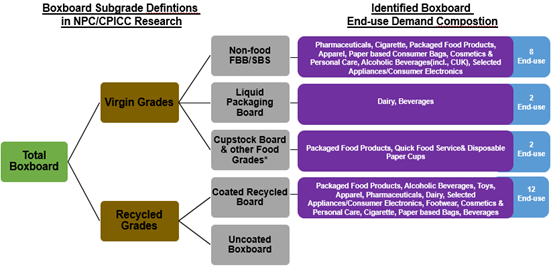

Chart 1

China Boxboard Demand Analysis & Forecast based on Sub Grades & End-Use Markets

Source: NPC Partners

Our actionable advisory is also based on proprietary modelling (see Chart 1), and industry mainstream database. The new analytical tools are able to reveal the full picture on China’s boxboard demand composition and outlook by sub grades and 13 major end-use markets such as quick food service, beverages, dairy, pharmaceuticals, packaged food products, etc. Since some end uses such as quick food service lacks sufficient quantitative data for measuring boxboard volumes, we estimate the use of cupstock board following a designated market sizing approach that assesses per-capita cup and food container/cartons usages.

On the company level planning, mill intelligence and cost benchmarking are integrated with strategy considerations such as major players positioning, production portfolio, etc. Major paperboard companies such as Asia Pulp & Paper, Sun Paper, China Paper Corp, Asia Symbol, Chenming Paper, Stora Enso, Nine Dragons Paper, Lee & Man Paper, and Fujian Liansheng Paper are analyzed. More than 100 boxboard machines have been studied.

Chart 2

Source: NPC Partners estimate & forecast analysis

Why is it necessary to understand China with new perspectives and new tools?

- The new demand–supply drivers and pulp and wastepaper trends under China’s “new phase” and new policy framework are impacting global pricing and volumes in multiple ways. Companies around the world would benefit from a new kind of advisory that could assist them to anticipate fast-changing market trends and new growth areas, rather than relying on the status-quo analysis or routine news reports.

- Understanding the China market requires a more in-depth study compared to a general global study, as the end-use market demand, policy, and pricing factors here are very different from the rest of world. NPC Partners' report is the only one that has been tracking China’s boxboard market for years.

- In our previously released studies a few years ago, NPC Partners successfully anticipated the consolidation of the boxboard supply and the policy change on use of plastics, and provided some useful action recommendations.

This is also the first report in the pulp and paper industry that combines market analysis and strategic insights, with more analysis on the new policy framework in China and their impacts. Extensive interviews with stakeholders including major boxboard producers, converters/end user, traders, government (Ministry of Environment of China, etc.) and associations, were conducted. Data has been collected from China Paper Association, Euromonitor, other market surveys, and other third-party data sources.

Chart 3

Source: NPC Partners

For further information on the report or inquiry on pricing and/or tailor-made content, please contact sales.service@npcpartners.com, or

visit the project web at: http://www.npcpartners.com/npccpiccboxboard.php

CONTACT INFORMATION:

Andy Tsui

NPC Partners Consulting

Phone: +852 8192-4535 (Hong Kong)

Email: sales.service@npcpartners.com

NPC Partners is a premier, innovative consultancy committed to assist the pulp & paper industry in developing powerful solutions, combining strategy and market insights beyond traditional industry space. In the fast-changing market environment there is need of new strategic analysis and out of box solutions which can bring new opportunities. NPC Partners' new approach and independent analysis will help the paper industry to achieve transformation and innovation goals.