2022 edition

In depth analysis of China's boxboard market and competitive landscape, trade dynamics and latest policy sets to 2026.

In depth analysis of China's boxboard market and competitive landscape, trade dynamics and latest policy sets to 2026.

Latest strategic insights on China's new phase: new pricing patterns, increasing global influences (supply, policy, etc.) and its end use market size and growth estimates.

Latest strategic insights on China's new phase: new pricing patterns, increasing global influences (supply, policy, etc.) and its end use market size and growth estimates.

Comprehensive and exclusive analysis of new drivers in China’s paper industry as well as the impact of new policies. For instance, new plastics limit initiatives and imported wastepaper ban are among the new key factors to the boxboard industry.

Comprehensive and exclusive analysis of new drivers in China’s paper industry as well as the impact of new policies. For instance, new plastics limit initiatives and imported wastepaper ban are among the new key factors to the boxboard industry.

2022 edition also includes the latest assessment of coronavirus’s impact to China’s economy and the boxboard demand, plus the new guidelines from China’s 14th 5-yr plan on the paper industry.

2022 edition also includes the latest assessment of coronavirus’s impact to China’s economy and the boxboard demand, plus the new guidelines from China’s 14th 5-yr plan on the paper industry.

Largest boxboard market with changing trade outlook:

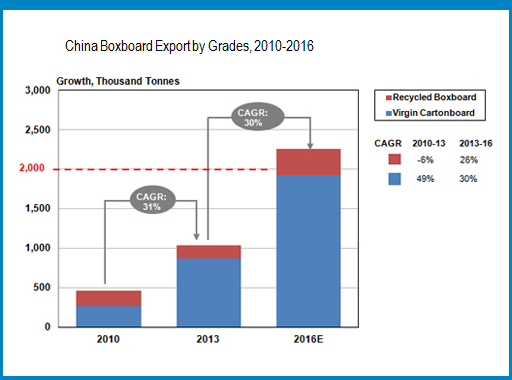

China is the largest boxboard market in the world, with imports and exports recording nearly 0.75 million tonnes and 1.6 million tonnes in 2021. For virgin grades, expanding supply surplus will prompt more space for increasing exports, while recycled grades expects some rebounds in imports。

New Phase in China’s domestic market:

China market would need a more in-depth study compared to a general global study as the end use market demand, policy, and pricing factors here are very different from the rest of world. NPC Partners' report is also the only one tracking China boxboard market for years.

This advisory report follows a unique structure that separates market analysis aspect and strategic planning aspect.

The analysis version (chapter 1-4) provides you a medium-term outlook with key data and insights for further analysis. Specifically, it provides 10-year extensive date sets plus 5-year outlook forecast for the entire China boxboard sector, the trade dynamics, competitive landscapes of Chinese boxboard mills, as well as policy analysis.

The strategy version (chapter 1 & 5-7) can help you review and refine strategy in China and outside China where China's influence is increased. It provides end use demand scale and growth analysis and advisory, China's increased export analysis, and Chinese major producers' profile and sales and production strategy, and cross-regional cost analysis.

1. Comprehensive edition: cover both market analysis & strategic advisory, first report of its kind in this paperboard sector

2. Analytical version: market study with in-depth perspective and extensive database

3. Strategy version: combine growth advisory (end use & market overall), competitive analysis, and trade analysis

● China boxboard demand, supply and trade dynamics (10-year historical data sets)

● Chinese exports and imports by sub-grade and sourcing/destination country

● Insights into the boxboard's new pricing pattern in 2020-2021

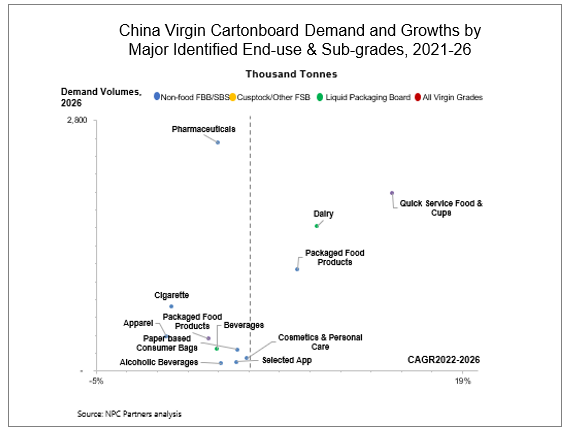

● 5-yr outlook to 2026 based on the most advanced end-use demand estimation model, trade and supply scenarios

● Cost competitiveness of major Chinese boxboard mills and asset analysis

● Understand China's macro environment and implications to boxboard market prospects

● Assess go-to-market strategy in China with demand and forecast by major end-use market sizes and sub-grades.

● How overseas market have emerged and increased for Chinese exports

& restructuring of supply creates some import opportunities

● Evaluate competitiveness of major producers in full details, & case studies of China's 'Reduce and Replace Plastics' trend, regional closure campaigns, and food board segments, etc

Executive Summary

Grade definitions

a.Understanding the nation’s new growth model and its implications for the paper industry

i.Summary of China's economic situation and policy actions in 2021

b.The COVID-19 Impact to China’s Paper Industry

c.New policy sets toward the 14th five-year period (2020–2025) and beyond: impacts to boxboard demand and supply.

d.Insights to China's changing wastepaper policies and future guides, etc

Analysis version, China Boxboard Market: In-depth perspective to 2026

a.Market Highlights in 2020-2021

b.Demand, Supply and Trade Dynamics

i.Market Demand by Grade

ii.Production and Trade by Grade

iii.Capacity Expansion

iv.Expansion Project Analysis

v.Overall Price Trend Analysis, 2020-2021

a.Chinese Boxboard Forecast Summary

b.Total Boxboard Demand Forecast by Grade, 2022-2026

c.Boxboard Capacity Forecast

d.Overall Production and Trade Forecast

e.Capacity Expansion Monitoring and Analysis, 2022-2026

f.Risks to the Forecast

a.Capacity and Machine Assets

b.Fiber Furnish, Coating Chemicals ad their main sources

c.Plies of Base Paper, Coating Layers and Coating Weights

d.Cost Competitiveness of Chinese Virgin Cartonboard Producers

e.Cost Competitiveness of Chinese Recycled Boxboarrd Producers

f.Cash Costs of Chinese Producers

Strategy version: Guide to Winning Strategy

a.Recommendations for Domestic Market Growth Strategy

b.End-Use based Forecast for Boxboard Sub-Grades, 2022-2026

c.Forecasting Methodology

d.Overview of Chinese Boxboard Demand by End-Use Industry, 2012-2021

e.Analysis of Major End-Use Downstream Markets for Boxboard

i.Apparel

ii.Dairy

iii.Alcoholic Beverages

iv.Pharmaceuticals

v.Footwear

vi.Toys

vii.Cigarettes

viii.Non-alcoholic Beverage

ix.Selected Home Appliances

x.Cosmetics & Personal Care

xi.Paper based consumer bags

xii.Packaged Food Products

xiii.Quick food service & Disposable paper cups

f.Notes on Other Boxboard Demand

a.Major Boxboard Producers Positioning and Profiles

i.Virgin Grades

1.Asia Pulp & Paper (APP) China

---Ningbo APP

---Ningbo Zhonghua Paper

---Guangxi APP

2.Shandong Bohui Paper (controlled by APP)

3.Shandong Sun Holdings

4.Chenming Paper Group

5.Zhuhai Hongta Renheng Packaging

6.Asia Symbol

ii.Recycled Grades

1.Nine Dragons Paper Industries

2.Jintian Paper

3.Fujian Liansheng Paper

b.Virgin Cartonboard Market in 2021

i.Domestic Prices for Commercial Packaging (Non-food grades) Prices

ii.Case Study 2022 update: “Reduce and Replace Plastics” trend & Considerations on China Market

iii.Special Research and Analysis 1: Liquid Packaging Board Market

iv.Special Research and Analysis 2: Food Grades Market

& Major Producer Prcie Analysis

c.Recycled Boxboard Market in 2021

i.Domestic Coated Recycled Board Price Movements

ii.Case Study 2022 update: Snapshot of China’s closure campaign: Fuyang’s experience (recycled boxboard grades)

d.Basis Weight and Distribution Practice for Boxboard Grades in China

a.Discussion of China's Expanding Impact on the Global Boxboard Import & Export Markets

b.More Analysis on the Chinese Boxboard Trade Scenarios

c.Firm-Level Behaviors, Export Pricing, and Exporting Destinations of Chinese Board

d.Brief Comments on Global Cost Competitiveness

(comprehensive edition: market & strategy)

The report is now available (latest update in March 2022).

Sales.service@npcpartners.com

+852 8192 4535

This report series is covered by seasoned experts and consultants on this topics at NPC Partners, whom together own more than 40 years of industry and consulting experience. China Paper & Pulp Industry Chamber of Commerce's staff team in Beijing also contributed to the market research.

This report series is covered by seasoned experts and consultants on this topics at NPC Partners, whom together own more than 40 years of industry and consulting experience. China Paper & Pulp Industry Chamber of Commerce's staff team in Beijing also contributed to the market research.

Key authors possess strong technical and business qualifications in the paper industry, previously holding key positions at leading industry analysis firms such as RISI, as well as top management consulting firms such as Booz & Co, PwC, Jacobs Sirrine Consulting and A.T. Kearney.

Key authors possess strong technical and business qualifications in the paper industry, previously holding key positions at leading industry analysis firms such as RISI, as well as top management consulting firms such as Booz & Co, PwC, Jacobs Sirrine Consulting and A.T. Kearney.

About NPC Partners

NPC Partners is a premier, innovative consultancy with experienced industry and management professionals committed to assist our clients in the paper industry and related industries in developing powerful solutions.

Our focus is on Pulp and Paper industry, with our deep industry expertise and management consulting skills, we have successful track record in assisting our clients. In the fast changing market environment there is need of new strategic analysis and out of box solutions which can bring new opportunities. NPC Partners' new approach and independent analysis will help the paper industry to achieve its goals.

About China Paper & Pulp Industry Chamber of Commerce (CPICC)

CPICC is a national level industry organization, founded by the leading companies in the pulp & paper and related sectors, which also serves as a bridge connecting the Party and Government to the paper industry.